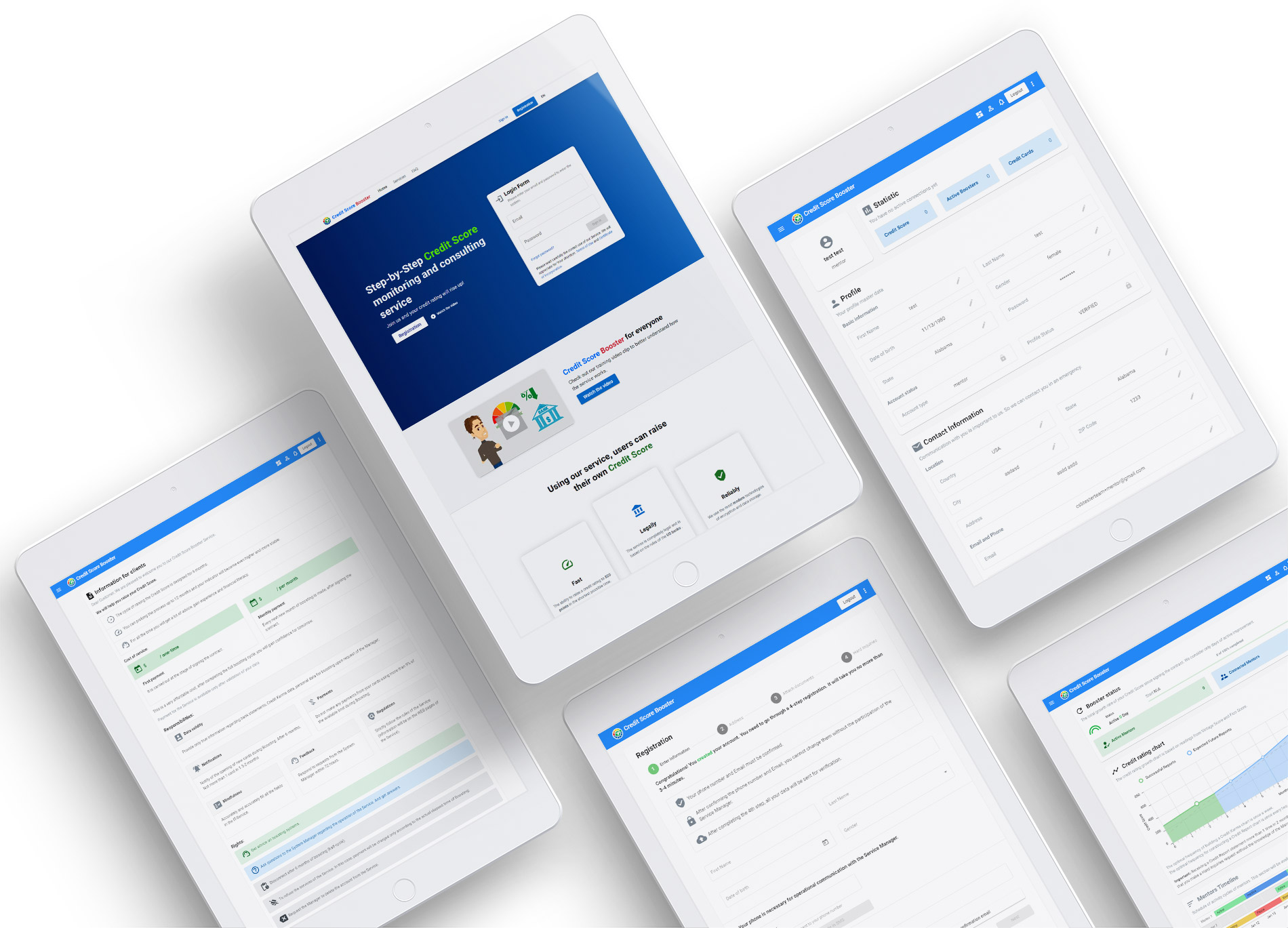

Step-by-Step Credit Score monitoring and consulting service

Join us and your credit rating will rise up!

Credit Score Booster for everyone

Check out our training video clip to better understand how the service works.

Using our service, users can raise their own Credit Score

-

Fast

The ability to raise a credit rating to 820 points in the shortest possible time.

-

Legally

The service is completely legal and is based on the rules of the US banks.

-

Reliably

We use the most modern technologies of encryption and data storage.

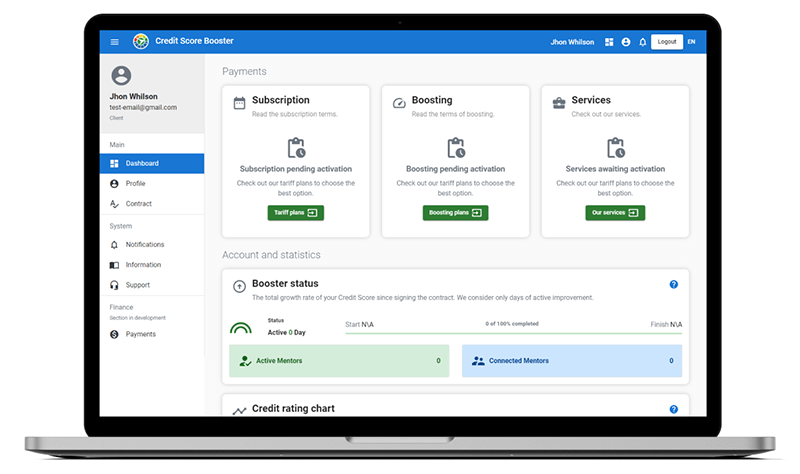

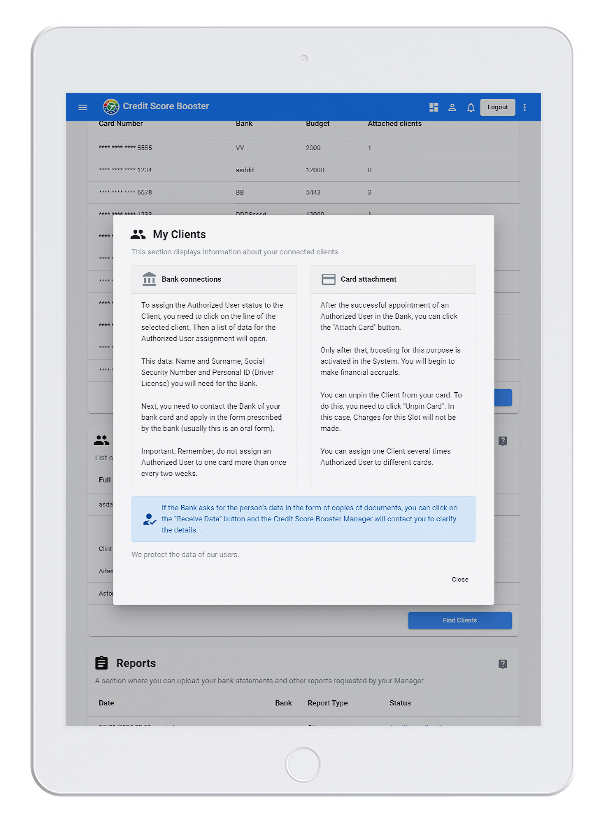

Credit Score Booster is a web-application with a wide range of functions

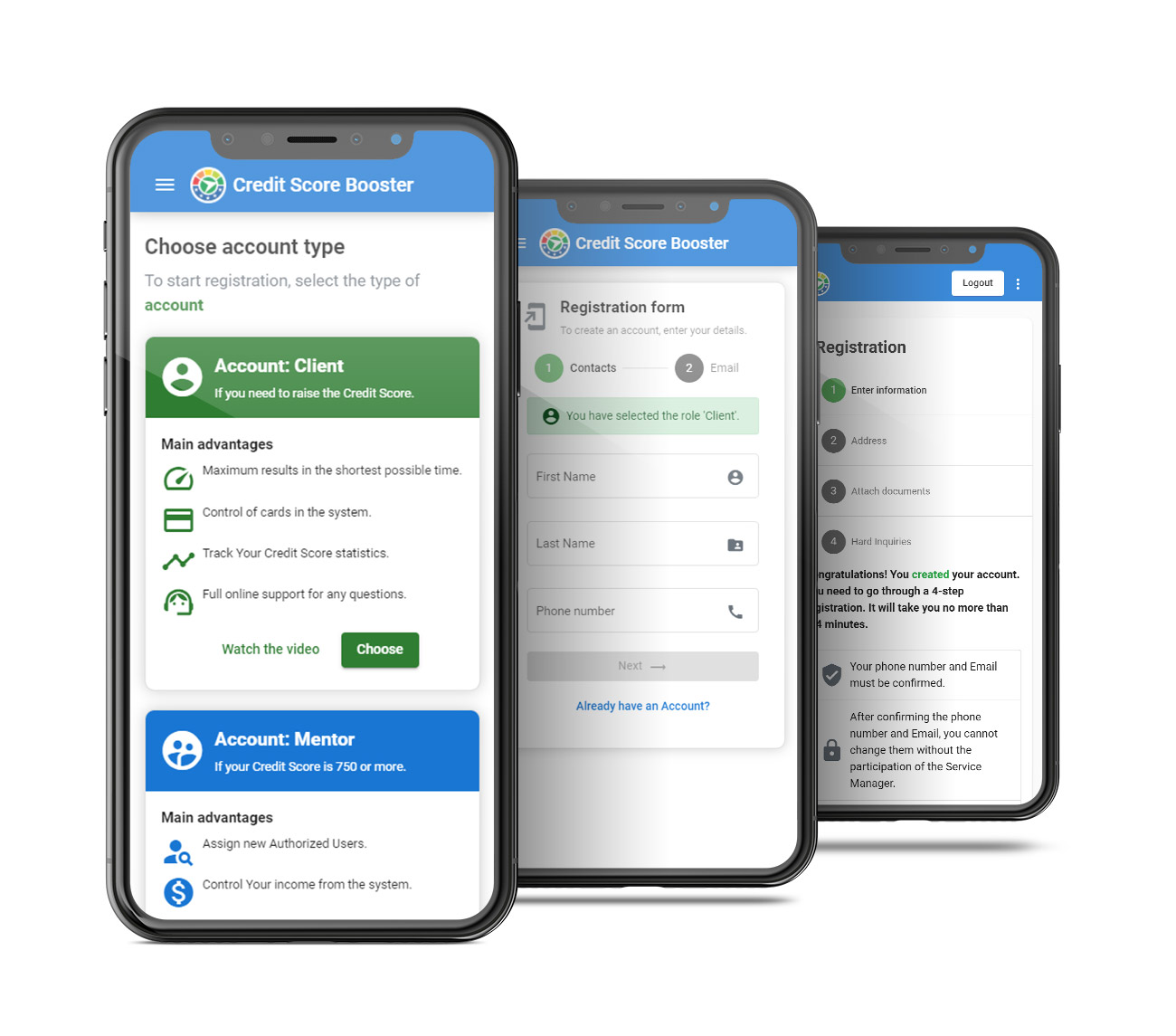

- Register in the system and enjoy the boosting process.

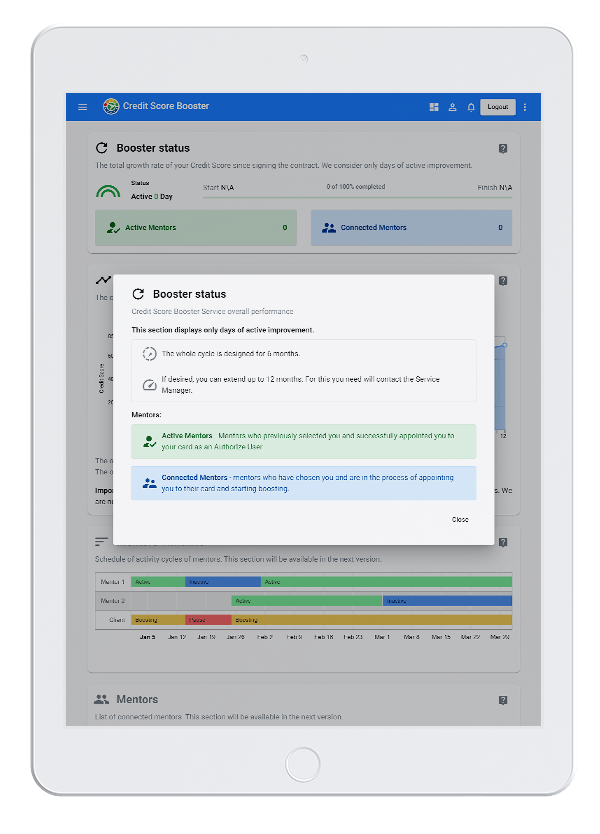

- Track Your statistics and growth graph of the Credit Score Index.

- Connected cards, active Mentors, and more.

- Confirm Your account and start working with us.

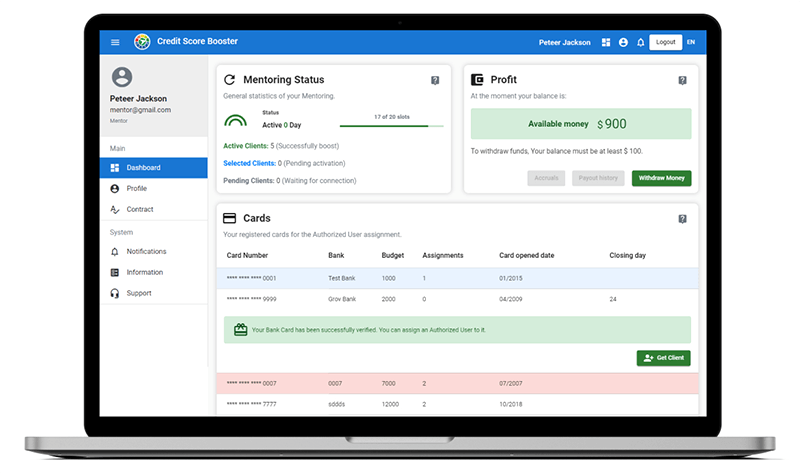

- Manage Your credit cards.

- Assign new Authorized User.

- Monitor Your earning.

-

ClientA citizen of America, or having a Social Security Number who needs to increase Credit Score

-

MentorA person who has a high Credit Score

The Mentor starts to monitoring the customer.

Manager starts to step by step consulting the customer.

The customers achieve their goals and then target new one.

This request is needed to identify a person and his problems.

When we receive the first official report , we will see the official Credit Score and problem areas, which are considered “red” for refusing a service. These are the problem areas: missed payments and collector work . If at least one of these two points is present, we have the right to refuse to start the service.

If Red problems are found in the client, we recommend contacting the Credit Repair Service to monitoring your credit history.

Before the start cycle, you can check the current Credit Score using the standart calculation system Credit Karma.

Together with the official request, a request is made through the Credit Karma service. And the value is fixed at the current moment.

After the launch of the service, a check will be carried out through credit karma every week to identify possible violations of the Contract. This will allow you to quickly respond to services and warn users.

Indications will be compared with the initial. Thus, even at the level of unofficial data, you can see growth of progress.

Extension after achieving your point target you can extend Your membership four any time and keep it on regular monthly basis.

Subscribes to Monthly membership and get wonderful results into your life.

The Client will have an opportunity independently start open new cards in banks with a higher credit limit.

At the time of launching the service, there should be no information about missed payments and any of the collections on files.

During the operation of the service , the Client should contact their assistant manager for any financial advisory Before any step forward.

-

Fast

You will achieve maximum results in the shortest time.

-

Support

Full online support for our customers on any issues.

-

Contracts

Contracts with the System will allow you to gently go to the way of Target points.

-

Billing control

We keep records and control of your accounts participating in the system.

-

Authentication

We use two-step authentication Google Authenticator.

-

Simplicity

Facilitate and automate the process of increasing Your Access to wealth.

Credit Score Booster t’s more than a service

Don’t miss your chance to use our services and achieve financial well-being.

Credit Score monitoring and improvement of the credit rating

Today, the service for improving the credit rating is very popular. After all, how your financial condition will be assessed during the assessment by creditors depends on the rating indicators.

How high your credit score is affects the success of important transactions. If you want to buy a car, a personal home, take out insurance, you will have to provide the results of a credit check. This is why improving your credit score is so important. To do this, you must understand what affects the receipt of points.

Why is a credit score important?

The rating is actually a forecast of how reliable the client is in terms of returning funds that have been borrowed. Points are awarded after at least six months of active credit history. But today there are effective ways to improve your credit rating.

In this case, it is necessary to focus on several key components. One of the most important metrics is your payment history. We are talking about information about how timely and in full you made payments on previous loans. The system takes into account how quickly you made regular payments and in what amount. Based on the data obtained, an average number is formed.

Also, the assessment of the credit rating depends on the amount of debt that is currently not repaid. It matters whether you paid off your credit card in full or continue to make regular payments.

It also matters how long your credit history is. It is optimal if you receive your first loans while still a student. Therefore, the earlier the client begins to increase the loan, the more positively it affects the final rating. But you can also quickly improve your credit score by using special programs.

So that your rating does not suffer, you should not take a large number of loans. It is better to have just a few loans that you manage and control skillfully. A reasonable disposal of available funds will have a positive effect on your rating. You also need to understand how to find out your credit score so that you can monitor it if necessary.

It also matters what types of loans you use. If you use several types of loans at the same time, this will help create the image of a person who skillfully manages his funds.

In order to improve your credit score, we also recommend that you significantly reduce your expenses. Determine for yourself the amount that will cover all your needs, but at the same time you will not go beyond your own capabilities. If you learn to live within your means, you can gradually improve your credit score.

If you do all of the above, you will be able to create a positive credit score that will help you make serious transactions without any problems.

How to find out your credit score

To be able to control your rating, you need a credit history. So that you do not have to do this yourself, it is better to use the Credit Score Booster application. Before you start working with a rating increase, you need to find out the current indicators. For this, the standard Credit Karma system is used.

In order to adjust your US credit score, you need to regularly receive information about your credit history. The service always provides up-to-date data. You can fix the obtained values in order to build a graph of changes in the future. Everyone will be able to see progress or detect shortcomings in a timely manner.

Up-to-date information can be received every week. The system will also report violations, if any. This way you can avoid a number of problems.

How to quickly improve your credit score

Not everyone has a good credit history. This hinders large transactions. Therefore, the service, which allows you to increase the number of points in a short time, is becoming increasingly popular.

This application works officially and is guided by the current legislation and the rules of banking systems. The client has the right to terminate the cooperation at any time or extend it in any convenient way.

Also, the application for improving the credit rating allows you to get qualified help from company managers at any time. Each client has a personal manager who monitors the credit rating and makes recommendations for improving results. Customers can get help and support on absolutely any issues. We recommend consulting with a personal manager before taking each step.

Membership must be renewed monthly. With ongoing support, you will be able to achieve the best results. At the same time, the client gets the opportunity to independently and with minimal effort open bank cards in absolutely any banking institutions.

Also, do not forget that you should not delay payments. Even with a slight delay, your credit score can drop significantly. If you make payments on time, after a few years you can afford to enjoy a number of discounts and great offers.

A quality credit rating improvement program will allow you to raise your rating to the maximum.

What credit score do you need

Today, the service of improving the credit rating is available to everyone. Focus on the number of points. The minimum score is 300 points. With such indicators, you can assume that you actually do not have a credit rating. The minimum number of points does not allow you to carry out complex financial transactions, with such indicators you can only apply to microfinance institutions or pawnshops if you can confirm the borrowed amount with property. A score of 579 is still considered very low, so you should strive to improve your scores.

Average scores are from 580 to 669 points. With such a rating, you still cannot use all the services of banking institutions. A rating up to 739 points is considered good. With this number of points, you can already apply to banks, getting loans to buy housing, cars and other important things.

The number of points up to 799 is considered very good. With this number of points, you get a lot of benefits from state banking institutions. For example, you will get a lower interest rate and a number of other benefits. A rating above 800 is considered exceptional.

By strictly following the recommendations of our managers, you can significantly increase the number of points, which will open up a lot of advantages and additional opportunities for you. But first you need to check your credit score in order to understand in which direction you should move. Using such a simple application, you will be able to increase your credit rating to the required indicators for even large financial transactions in a fairly short time.

-

Informationinfo@scobooster.com

-

Questionsaskme@scobooster.com

-

Supportsupport@scobooster.com